Widening Trade Gap: Bangladesh will face difficulties with alternative currencies

Shining BD Desk || Shining BD

An alternative to the US dollar in international trade will be challenging for Bangladesh due to its huge trade gaps with India and China, economists have said, advocating for introducing a monetary union to address the situation.

A monetary union is an intergovernmental agreement that involves two or more states sharing the same currency.

The discussion on the alternative currency has come to light recently when Bangladesh Bank (BB) allowed the use of the Chinese Yuan for forex transactions and the State Bank of India suggested businesses to halt trade in the US dollar with Bangladeshi counterparts.

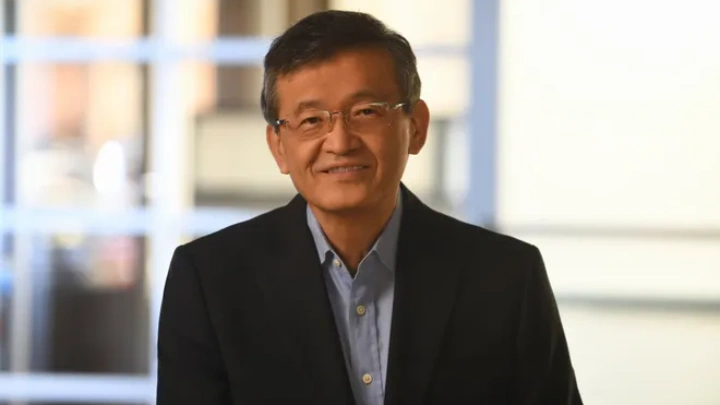

Policy Research Institute (PRI) Executive Director Ahsan H Mansur said that there is limited demand for Rupee or Yuan in banking channels as merchants prefer dollar in international trade.

“If we look into the balance of trade with India and China, Bangladesh is in an unfavourable situation with increasing imports from these countries. If we want to replace the dollar at this moment, the banking sector may get Rupee and Yuan which is hardly convertible in international trade,” Dr Mansur, a former staff of International Monetary Fund, told the Daily Sun.

The economists suggested making a test run of the sub-regional currencies at the government level first to assess the challenges before implementing this method in the private sector.

In FY 2021-22, Bangladesh imported products of over $20 billion from China though exports to China are less than $ 1 billion, according to Research and Policy Integration for Development (RAPID).

Bangladesh incurred a trade deficit of $14 billion with India in 2021-22 and this has almost trebled from $5 billion in 2015-16.

Economic analysts and bankers said the introduction of alternative regional currencies to the US dollar in international trade will take time as European Union adopted Euro after a decade-long process.

RAPID Chairman Dr Mohammad Abdur Razzaque does not see any short-term solution for mitigating the pressure on foreign reserves with alternative currencies.

“The main reason is the trade gap with the countries belonging to Rupee and Yuan. Besides, there is a low acceptance of Taka in the region. There will be no problem if the foreign exporters in India and China allow Taka in cross-border trade. However, the scenario is different for us. There is no alternative to export diversification to maintain stable forex reserves,” Dr Razzaque told the Daily Sun.

Policy Exchange Chairman Dr Masrur Reaz thinks the concept of regional currency may take time to get effective against the dollar as the demand is limited in international trade.

“The best practice of regional currency lies in Euro which took more than a decade to hit the market as monitory union of 19 countries. In this region, the discussion of monetary union may be continuing at the government level,” Dr Reaz told the Daily Sun.

Bangladesh’s foreign reserves reached $36.85 billion on Wednesday from $39.06 billion on August 31.

By Daily Sun

Shining BD