Inflation hits 13-year high of 9.73% in FY24

DailySun || Shining BD

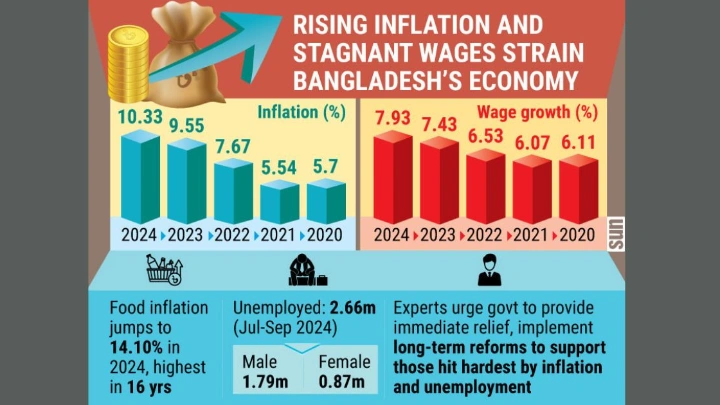

Bangladesh’s yearly inflation hit a record high of 9.73% in the just concluded fiscal year 2023-24, up from 9.02% a year ago, despite a target to keep inflation within 6%.

The previous highest annual inflation rate was 10.92% in FY11.

Meanwhile, in June 2024, the monthly inflation slightly fell to 9.72%, down from 9.89% in May, according to data from the Bangladesh Bureau of Statistics (BBS).

The highest monthly inflation in FY24 was 9.93% in October.

The government plans to set an inflation target of 6.5% for FY25. However, experts warn that reducing inflation will be challenging until economic conditions improve.

Bangladesh has been grappling with high inflation for the past two years, with monthly rates consistently over 9%.

Despite government efforts to curb inflation, no measures have turned effective, making high inflation one of the country’s biggest economic challenges.

Experts say inflation acts like a tax, affecting everyone, especially the poor and middle class, whose purchasing power has significantly eroded over the past two years.In FY24, food inflation rose to 10.65% from 8.71% in FY23, while non-food inflation dropped slightly to 8.85% from 9.39%.

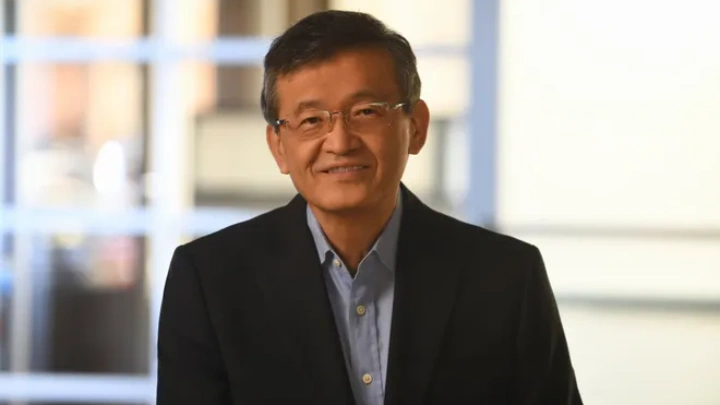

Dr Ahsan H Mansur, executive director of the Policy Research Institute (PRI), told the Daily Sun that inflationary pressure has increased due to the dollar crisis.

He noted that headline inflation has been above 9% since March last year, despite government plans to keep it within 6%. “Our growth will not come easily because the condition of our banking sector is very bad,” he added.

Economists noted that inflation has forced people to spend more than their income for over a year and a half. Although the Bangladesh Bank attempted to control inflation by increasing commercial banks’ lending rates, this approach did not work, they said.

Dr Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID) and research director of PRI, said a contractionary monetary policy is necessary to tame inflation. He emphasised the need to implement this policy effectively, despite the challenges.

“Inflation has been above 9% for over a year. But we are too late to take the policy. Recently, the central bank took some policies to control inflation. One of these is contractionary monetary policy. Now the thing to see is how much we can implement the policy. This is the big challenge,” he stated.

He further noted that there is no alternative but to let the interest rate be determined by the market.

“It is better if it is effectively implemented. Many people say that if the loan interest rate increases, the investment will decrease. But this must be done first to control inflation.”

“Any reform is a painful process. But if inflation comes down, the interest rate can be reduced again. This is how inflation is controlled in many developed countries,” Razzaque continued.

Shining BD