Tax hike looms for businesses, homes alike

DailySun || Shining BD

The government is set to raise both direct and indirect taxes in the upcoming fiscal year’s budget in an effort to meet a challenging revenue target, according to sources at the Ministry of Finance, which is likely to have a significant impact on businesses and consumers alike.

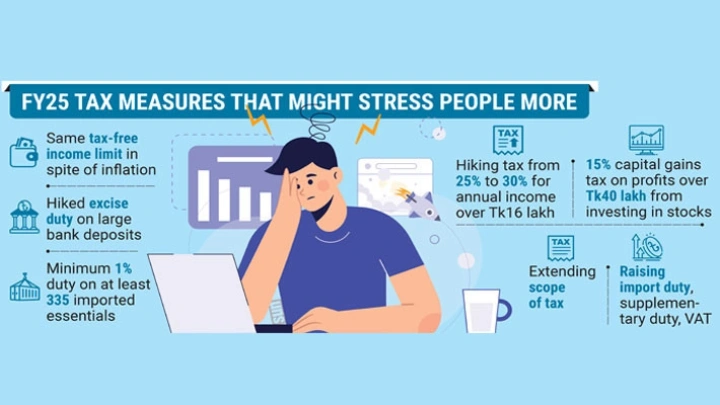

Income tax or direct tax is likely to be hiked for the higher income range in upcoming fiscal 2024-25, but the tax-free income limit will probably be kept unchanged despite the inflation, said sources.

However, the biggest burden on people are likely to be indirect taxes, like import duty, supplementary duty and value added tax (VAT). A VAT rate of 15% on many products will have a huge impact on the market, said experts.

Besides, over 300 essential products which were earlier exempted from import duties might be subjected to import duties in the next budget, said sources. Naturally, the consumers will have to pay the additional VAT and duty.

Apart from these, the excise duty on the money kept in the bank is also going to be increased in the upcoming budget, said sources.

The finance ministry sources said advice from the International Monetary Fund (IMF) has been given importance in preparing the next budget. Following their advice, tax cuts will be reduced in some cases.

Finance Minister Abul Hassan Mahmood Ali will present the FY25 budget on 6 June. According to Finance Division sources, the size of the proposed FY25 budget will be around Tk7.96 lakh crore, which is 4.6% more than the budget of the outgoing fiscal.

The new budget will set a revenue target of Tk4.80 lakh crore, which might create pressure on the National Board of

Revenue (NBR) as it will be responsible for collecting the income tax, VAT and import duty, said experts.

The government plans to remove the tax exemption benefits currently enjoyed by various sectors in the next fiscal year to raise revenue to meet the special IMF’s conditions, said sources.

Due to the same conditions, zero duty benefits on many basic products are also going to be withdrawn. Minimum 1% duty might be imposed on at least 335 products of various sectors, according to sources.

Dr Ahsan H Mansur, executive director of Policy Research Institute (PRI), told the Daily Sun that the headline inflation has been above 9% since March last year, but the government planned to keep it within 6% in the current fiscal.

Revenue collection targets could not have been met by the current tax administration. Transition from this situation requires a modern tax administration, which in turn requires separation of tax policy and administration.

Khondaker Golam Moazzem, research director of Centre for Policy Dialogue, said already the burden of high inflation falls disproportionately on the poor and low-income households.

With the persistent rise in the prices of essential food items, people in Bangladesh are now spending more on food than in other richer countries. Now it is time to take steps on the proper implementation of the policies undertaken by the government.

Tax-free income limit not increasing

Sources at NBR said they think increasing the tax-free income limit will leave a large number of people out of the income tax fold. At present, the tax-free income limit is Tk3.5 lakh.

Meanwhile, NBR is planning to collect additional tax from the rich to increase the revenue. Currently, people with annual income over Tk16 lakh have to pay 25% tax. There are plans to increase it to 30%. Besides, there will be initiatives to extend the scope of tax.

Apart from this, big bad news might come for the investors in the capital market. There may be a decision to levy 15% capital gains tax on profits over Tk40 lakh earned by investing in the stock market.

Excise duty might increase

In the FY25 budget, there may be an announcement to increase the rate of excise duty for large deposits.

Currently there is no excise duty on bank accounts up to Tk1 lakh. The depositors have to pay Tk150 duty for accounts with Tk1 lakh to Tk5 lakh, and Tk500 for accounts with Tk5 lakh to Tk10 lakh. There will be no change in these two levels.

The range of bank accounts holding from Tk10 lakh to Tk1 crore will be broken into two groups. Excise duty of Tk3,000 will be levied for deposits ranging from Tk10 lakh to Tk50 lakh as before, while the excise duty for accounts with Tk50 lakh to Tk1 crore might be hiked to Tk5,000.

The tier of Tk1 crore to Tk5 crore, for which currently the excise duty is Tk15,000, might also be broken down. Tk10,000 excise for accounts ranging from Tk1 crore to Tk2 crore, and Tk20,000 for accounts with Tk2 crore to Tk5 crore might be imposed.

Every year between January and December if the amount of deposits in any bank reaches the limit of one lakh taka or above, then the excise duty is to be paid at the specified rate. Even if it touches the limit multiple times, excise duty is deducted only once. No excise duty is deducted if the amount is less than Tk1 lakh.

Shining BD