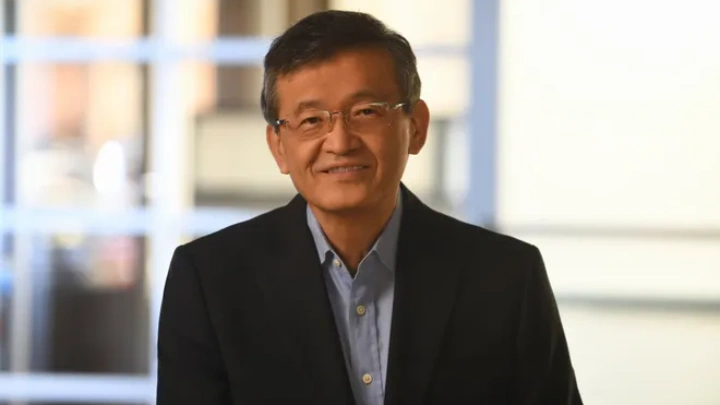

Tax collection target is given without considering NBR's capacity: Chairman Abu Hena

DailySun || Shining BD

The capacity of the National Board of Revenue is not considered while announcing tax collection targets every year in the national budget, said NBR Chairman Abu Hena Md Rahmatul Muneem.

He made the remarks at a dialogue titled “Digitalisation of the Taxation System in Bangladesh: The Next Frontier” on Sunday. Centre for Policy Dialogue (CPD) organised the discussion.

The NBR boss said the tax collection target is given as a percentage of the previous year’s target.

“But this is not given on the basis of the amount of tax being collected at the end of the year. Targets need to be chased throughout the year. But not much, including tax reform, is done. At the end of the year, everyone says NBR has failed to meet the target.”

State Minister for Finance Waseqa Ayesha Khan was present as the chief guest.

CPD Executive Director Dr Fahmida Khatun chaired the session while CPD Distinguished Fellow Professor Mustafizur Rahman delivered the keynote speech.

In the discussion, the speakers focused on the effectiveness of the various initiatives taken in view of digitalisation of Bangladesh’s taxation system.

They discussed what has worked, what has not worked and why, the lessons learned from past experience and what further steps will need to be taken in moving forward in this connection.

They said although the NBR has been digitised to a large extent in tax collection, its benefits are not being realised.

Digitisation in Customs, VAT, Tax and Payments lacks coordination between these departments, they alleged.

According to them, due to this lack of coordination, it is not possible to stop tax evasion, which is one of the problems of NBR.

In the keynote, Mustafizur Rahman observed that the country's annual development programme (ADP) is becoming dependent on debt.

“The interest rate of the loan that is being taken now is very high. The government's 7th five-year plan targeted raising the tax-GDP ratio to 20% by 2020,” he said.

Professor Rahman added, “If that were the case, there would be no need to borrow for annual development programmes. In the last few years, the tax-GDP ratio has declined in the country.”

In the presentation he showed that the country's tax-GDP ratio was 10.36% in the fiscal year 2020-21 while in the FY 2021-22 it was 8.43%; In the FY 2022-23, it was 8.26%.

“The tax-GDP ratio target for the current fiscal year 2023-24 has been set at 9.99%. It is not possible to achieve this goal in the current way of tax collection.”

Distinguished Fellow of CPD Dr Debapriya Bhattacharya spoke as a special commentator.

He said that if the tax system is digitalised, transparency can be ensured.

“It is necessary to focus not only on tax collection but also on providing services to taxpayers.”

He said that if the distance between taxpayers and tax collectors can be reduced, the process will be easier.

The NBR chairman said although the revenue collection is increasing, the tax-GDP ratio remains low.

The income tax was 10% (of GDP) in FY 1972-73. Now the direct taxes have increased. Businessmen say business cannot be done under the tyranny of the NBR. When common people go to the market, they say that the VAT is too high.”

He, however, said the number of people filing returns in the country has doubled in the last four years.

About the tax system reforms, he said, “NBR has to be busy with revenue collection throughout the year. That is why it is not possible (for it) to innovate in the tax collection system.”

Team Leader of Inclusive Governance, Delegation of the European Union to Bangladesh, Enrico Lorenzon delivered Introductory remarks.

NBR former member (tax policy) Md. Alamgir Hossain, Bangladesh Garment Manufacturers and Exporters Association director and former president of Dhaka Chamber of Commerce and Industry Shams Mahmud, and Senior Public Sector Specialist at The World Bank Syed Khaled Ahsan were among other distinguished discussants at the event.

Shining BD