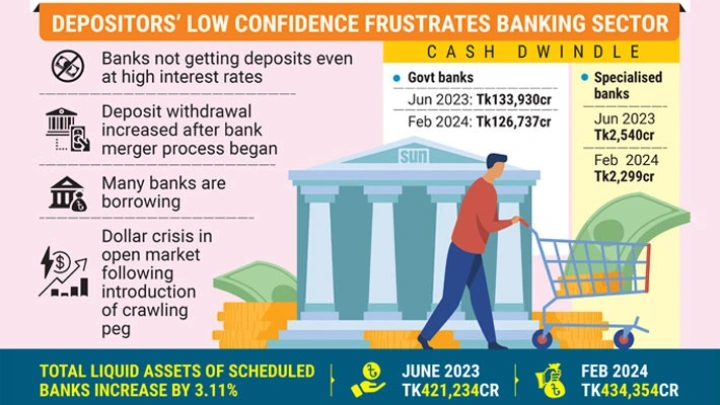

Deposit rush drains banks as confidence plummets

DailySun || Shining BD

The crisis of confidence in the country’s banking sector has been apparently deepening as many people are reluctant to keep money in banks even at high interest rates while many others are withdrawing deposits at an alarming rate.

As a result, the banking sector is facing a liquidity crisis, which in turn is hampering investments in different other sectors. Many banks are borrowing from the central bank, while some are facing capital shortage, said people involved in this sector.

Experts said the banking sector is in turmoil due to the frequent changes in decisions by the Bangladesh Bank.

The central bank decided to implement a SMART rate for loans last year to tame inflation, but could not do it effectively. Then, 10 months after launching the SMART rate, the central bank scrapped it and returned to market-driven interest rate last week after four years.

The central bank also termed some banks weak and decided to merge them with stronger banks, saying the decision will be implemented even if force is required to do so. Then it suddenly retreated from the merger process, after dealing a severe blow to the customers’ confidence in the whole sector, said experts.

Besides, the regulatory body’s unsuccessful attempt to control inflation by repeatedly increasing the policy rate drove down people’s trust in banks, they added.

Banks facing financial crisis are currently collecting fixed deposits at 12% to 13% interest. The top executives of some private banks in the country told the Daily Sun that term deposits are not available even after offering over 11% interest.

Dr Ahsan H Mansur, executive director of Policy Research Institute of Bangladesh, told the Daily Sun, “There has been a lack of discipline and enforcement of the law in the banking sector. It is steadily getting worse. The regulatory body took some policies but they failed to implement them properly. This is the root of people’s distrust of banks.”

At the same time, many have used the banks to expand their personal businesses. Many banks lack corporate governance.

Those who are in the boards and management of the bank are using the banks for their own interests, said Dr Mansur.

He said, “People of Bangladesh have no place to move away from the banks, because we have not developed a strong capital market. There is virtually no alternative destination for savings or investments.

So, people will go back to the banks with their money.

“However, awareness among people is increasing. Currently, the people watch out for good banks and bad banks. They are transferring money from the weak banks to the good ones.”

Salehuddin Ahmed, former governor of the Bangladesh Bank, said money has gone out of banks for a lack of customers’ confidence resulting from the long-standing irregularities, and it is not coming back. Provisions should be made to reduce the amount of defaulted loans. A particular group is laundering money abroad. Banks are also not able to manage liquidity well.

The notion that money will not be available if a bank is closed must be removed from people’s mind. Banks are closing down in different countries of the world but customers there face no problem getting back their money, he said.

Merger announcement deals severe blow to banks

A number of bank employees said that the central bank recently

identified some banks as weak for the merger process.

If the regulatory body says that a bank is weak, then its customers will have no confidence in it. If all the customers start withdrawing money together, it will not be possible for anyone to handle the situation.

Apparently, deposit withdrawal rates have increased due to lack of customers’ confidence after the bank merger process began. According to sources at the financial institutions, several institutional depositors have recently applied to withdraw money from the weak banks.

The Basic Bank has already lost over Tk2,500 crore of deposits since merger announcements were made, said sources at the bank. Customers have withdrawn around Tk150 crore from the Bangladesh Development Bank Limited as well since the process was declared, said sources.

Other banks that were listed for merger are also facing a similar situation.

Customers of the strong banks also started withdrawing their money after hearing the news that those institutions would merge with the bad banks. They feared that the healthy financial institutions would lose their prowess in maintaining strength. As a result, most of the banks have been facing a liquidity crisis.

According to the Bangladesh Bank data, at the beginning of the current fiscal year in June 2023, liquidity or cash in government banks stood at Tk133,930 crore, which reached Tk126,737 crore in February this year, decreasing Tk7,193 crore in eight months.

Similarly, liquidity in the specialised banks was Tk2,540 crore in June 2023, which dropped to Tk2,299 crore at the end of February this year.

According to a central bank report, the total liquid assets of scheduled banks increased by 3.11% to reach Tk434,354 crore at the end of February 2024, from Tk421,234 crore in June 2023. That means, the liquidity in the overall banking sector has increased slightly, but the flow of cash in the government banks has decreased.

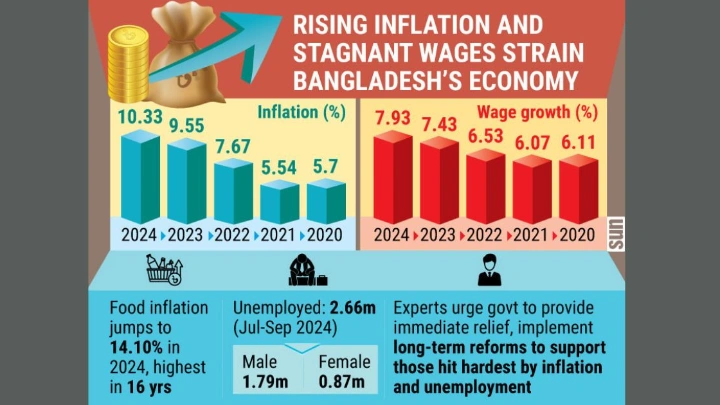

In July last year, the central bank adopted the policy of increasing the interest rate on bank loans to reduce the inflation.

At the same time, initiatives were taken to control the flow of money in the market by raising the policy rate to 8%.

Due to the liquidity crisis and the central bank’s policies, the interest rate on bank loans is continuously increasing in the country. In April this year, the maximum interest rate on bank loans was fixed at 13.55%.

Until June last year, the maximum interest rate on bank loans was fixed at 9%.

The loan interest rate has increased by 4.55% in the last nine months.

However, the effect of interest rate hike on inflation is not yet visible. In March this year, the average inflation rate in the country was 9.81%.

According to the Bangladesh Bureau of Statistics (BBS), the country’s inflation rate has been above 9% for 21 consecutive months.

So, on Wednesday The Bangladesh Bank decided to return to a market-driven interest rate regime, raised the policy rate and devalued the local currency.

Shining BD