Fruit imports surge as Ramadan pushes up demand

DailyStar || Shining BD

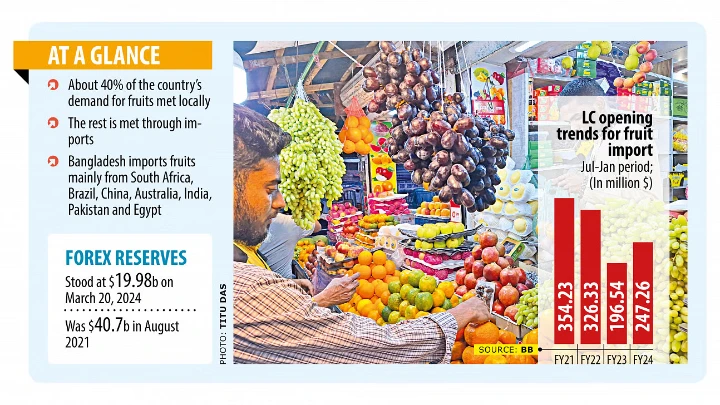

When Bangladesh's foreign currency reserves started to dwindle two years ago and the authorities moved to curb imports, fruits became one of the first victims of the restrictions since the country spent roughly $450 million in 2021-22 to procure them.

Government agencies tightened rules on the imports of fruits, chiefly oranges, apples and grapes, in their efforts to reduce import costs and tackle a deepening dollar shortage.

For example, the National Board of Revenue (NBR) raised the regulatory duty from 3 percent to 23 percent, while the Bangladesh Bank imposed conditions that importers would have to pay a full amount of the cost in advance for the imports of fruits and other non-essential products.

The initiatives worked as the opening and settlement of letters of credit (LCs) fell in the next two years. However, the imports of nutritious items are picking up though the dollar crisis still persists.

Traders opened LCs worth $247.26 million in July-January of the current fiscal year of 2023-24, up 25.81 percent year-on-year, central bank data showed.

The purchase from external sources was $196.54 million in the identical seven months of the previous financial year and $326.33 million in 2021-22.

Importers say banks have become liberal in facilitating the imports since the availability of the US dollars has increased while fruit traders are eager to buy even after paying the full cost upfront.

The LC opening rate was low in 2021-22 and 2022-23 due to the impacts of Covid-19 as consumption declined amid the health crisis. The LC opening has been relaxed in the current fiscal year, according to Serazul Islam, president of the Bangladesh Fresh Fruits Importer Association.

"Ramadan has played a major role behind the jump in the LC opening rate."

The demand for fruits goes up considerably during the fasting month compared to other times because devotees love to break fast with dates and water as well as fruits.

Islam also notes that the demand for imported fruits stays high from September to January owing to a reduction in the supply of locally grown ones.

One of the key factors that sent the fruit imports lower was a 25 percent reduction in the value of the taka against the US dollar in FY23 as the foreign currency reserves depleted due to escalating imports in comparison to inflows of the international currencies in the form of remittances and exports.

The reserves stood at $19.98 billion on March 20, down from $40.7 billion in August 2021, data from the BB showed. The country had reserves of $31.20 billion at the end of FY23 and $33.4 billion in 2021-22.

Mohammad Ali, managing director of Pubali Bank, says the reserve situation has improved slightly thanks to various steps initiated by the BB.

"The dollar rate is fairly tolerable now. Therefore, this has led to an increase in the LC openings and imports."

However, due to higher inflation, the price of fruits is much higher than in the past. The Consumer Price Index grew 6.15 percent in FY22 and 9.02 percent in FY23.

The elevated price trend shows no signs of slowing down: It averaged 9.67 percent in February.

Mozammel Haque, a 32-year-old resident in the capital's Mirpur, said that the price of imported fruits has significantly increased this year. Consequently, he has cut back on fruit purchases by 30 to 40 percent.

He requested government agencies investigate whether traders are making excessive profits since the price of some fruits has risen at an abnormal rate.

About 40 percent of the country's demand for fruits is met locally, while the rest comes from imports.

Apples come from South Africa, Brazil, China, and Australia, pomegranates from India, pears from Pakistan, sweet oranges from Egypt, tangerines from China and India, and grapes from India, industry people say.

Shining BD